Worker’s compensation is a very important, yet often overlooked aspect of running a business.

For those who don’t know, worker’s compensation, also known as workers comp, is insurance for when something harmful happens to an employee on the job. Sometimes this can be expensive, so insurance may be required.

Worker’s compensation doesn’t include everything, however. Generally, it can be summed up as any money you give your employee to cover medical expenses, loss of income, or anything else that is caused by an event at the workplace. However, this is not all-encompassing. It doesn’t cover things like injuries caused by a fight that the employee started, Injuries caused intentionally by the employee, or injuries caused by the employee while they were intoxicated at work.

However, worker’s compensation laws vary from state to state, so I would suggest using a site like Insureon that shows what you need in your company’s state.

The next step is trying to find what insurance provider to use.

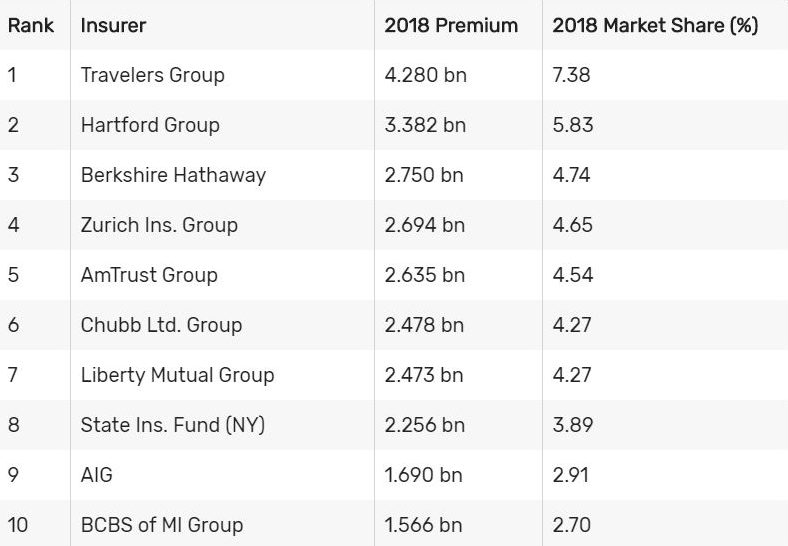

According to The Balance Small Business, these are the top ten worker’s compensation insurers as of 2018.

In my opinion, I would do some shopping and find what worker’s compensation insurance would work best for you.

When shopping around for your insurance, it would be a good idea to have the statistics of your company ready to go. This entails how many employees need coverage, the number of employees at your business The type of work employees will be doing, and your payroll size. This will allow you to make any transactions and get the quotes you’ll need quicker.

But what happens when the unlucky day actually comes when you have to file a claim? What will you need?

Well, according to The Hartford, the second-largest company on the list above, it can vary state to state but a general rule of thumb says you need these specific pieces of information for the most part:

- Company information (account number and location, policy number)

- Injured employee information (name, date of birth, address, phone number, Social Security number, age, gender, etc.)

- Details of the incident (date of the incident, type of injury, exact body part injured, the cause of injury, estimated number of days the employee will lose, anticipated return date, any witnesses, etc.

Hopefully, this short article will help you find what you need for worker’s compensation. These things are never cut and dry and making claims can be a drag especially when dealing with insurance companies. The best course of action would be to find a company that is known for customer service, that fits your budget, and have all your information at the ready to make everything run smoothly as possible.

If you want to join the conversation, like us on Facebook!

To read more articles, subscribe to our newsletter!